Yesterday, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act stimulus package to provide emergency relief for those suffering financial hardships. This package is the third in a series of economic measures in response to COVID-19.

Phase 1 also known as the Coronavirus Preparedness and Response Supplemental Appropriations Act—was enacted into law March 6, providing $8.3 billion in emergency funding for federal agencies to respond to COVID-19. Phase 2 became law as of March 18 and contained provisions for paid sick leave, free COVID-19 testing, food assistance, unemployment benefits, and requirements that employers provide additional protection for health care workers. Phase 3, the CARES Act—seeks to expand upon the prior phases by providing greater assistance to individuals, small businesses, state and local governments, tribal governments, and key industries impacted by COVID-19 (e.g., hospitals, airlines). It is unprecedented in size as well as scope and seeks to flood the economy with capital during this ever-evolving public health crisis.

Below is a summary of the more substantial provisions contained in the CARES Act that we anticipate could impact our clients.

Provisions for Businesses:

- Small Business Interruption Loans – This provision of the Act provides for two types of small business interruption loans. The Economic Injury Disaster Loan (EIDL) program is administered through the Small Business Administration (SBA) and provides low-interest disaster loans of up to $2,000,000 and a maximum repayment term of 30 years.

- In addition, Paycheck Protection Program loans are administered by lending institutions and capped at $10 million for businesses and nonprofits impacted by the COVID-19 pandemic. Here are some pertinent details on Paycheck Protection Program loans:

- Guaranteed 100% by the SBA (no personal guarantees or collateral required).

- Limited to a formula tied to payroll costs-and can cover employees making up to $100,000 per year.

- Must be taken out between February 15, 2020, and June 30, 2020.

- May be forgiven for amounts used to cover basic operating expenses such as payroll costs, rent and mortgage, and utilities for up to two months from the loan origination date.

- Have a maximum maturity of 10 years and 4% interest if not forgiven

- Loan payments may be deferred for up to one year.

- Loans forgiven under this provision are not required to be included in income as cancellation of debt.

- A refundable employer retention credit equal to 50% of qualified wages against quarterly employment taxes, to offset up to $10,000 of wages paid per employee for wages paid after March 12, 2020, and before Jan. 1, 2021. Available to employers whose operations have been fully or partially suspended as a result of a government order limiting commerce, travel, or group meetings. The credit is not available to employers receiving Small Business Interruption Loans.

- Net operating loss (NOL) carrybacks are allowed to fully offset income for tax years 2018–2020 and may be carried back five tax years. The NOL limit of 80 percent of taxable income is also suspended, so firms may use NOLs they have to fully offset their taxable income.

- Taxpayers may defer payment of the employer portion of payroll taxes through the end of 2020 (the first 50% of the deferred amount is due by December 31, 2021, and the second 50% is due by December 31, 2022).

For taxpayers who are subject to the interest limitation rules, they may now deduct business interest expense up to 50% of adjusted taxable income (ATI) for the 2019 and 2020 taxable years (except partnerships, which are still limited to 30% of ATI). - A correction to the 2017 Tax Cuts and Jobs Act (TCJA) that allows the 100% bonus depreciation deduction for “qualified improvement property”, which includes qualified leasehold and retail improvement property and qualified restaurant property. Taxpayers are allowed to retroactively apply this correction to tax years starting in 2018.

Provisions for Individuals:

- Penalty-free withdrawals from qualified retirement plan funds of up to $100,000 for withdrawals made between January 1, 2020, and December 31, 2020. Distributions can be contributed back to the plan over a 3-year period.

- A temporary waiver of required minimum distributions from a retirement plan or IRA for calendar year 2020.

- Creates a $300 partial above-the-line charitable contribution for filers taking the standard deduction and expands the limit on charitable contributions for itemizers.

- Waives the 10 percent early withdrawal penalty on retirement account distributions for taxpayers facing virus-related challenges. Withdrawn amounts are taxable over three years, but taxpayers can recontribute the withdrawn funds into their retirement accounts for three years without affecting retirement account caps. Eligible retirement accounts include individual retirement accounts (IRAs), 401Ks and other qualified trusts, certain deferred compensation plans, and qualified annuities. The bill also waives required minimum distribution rules for certain retirement plans in calendar year 2020.

- Certain employer payments of student loans on behalf of employees are excluded from taxable income. Employers may contribute up to $5,250 annually toward student loans, and the payments would be excluded from an employee’s income.

- Expanded unemployment insurance (UI) for workers, including a $600 per week increase in benefits for up to four months and federal funding of UI benefits provided to those not usually eligible for UI, such as the self-employed, independent contractors, and those with limited work history. The federal government is incentivizing states to repeal any “waiting week” provisions that prevent unemployed workers from getting benefits as soon as they are laid off by fully funding the first week of UI for states that suspend such waiting periods. Additionally, the federal government will fund an additional 13 weeks of unemployment benefits through December 31, 2020 after workers have run out of state unemployment benefits.

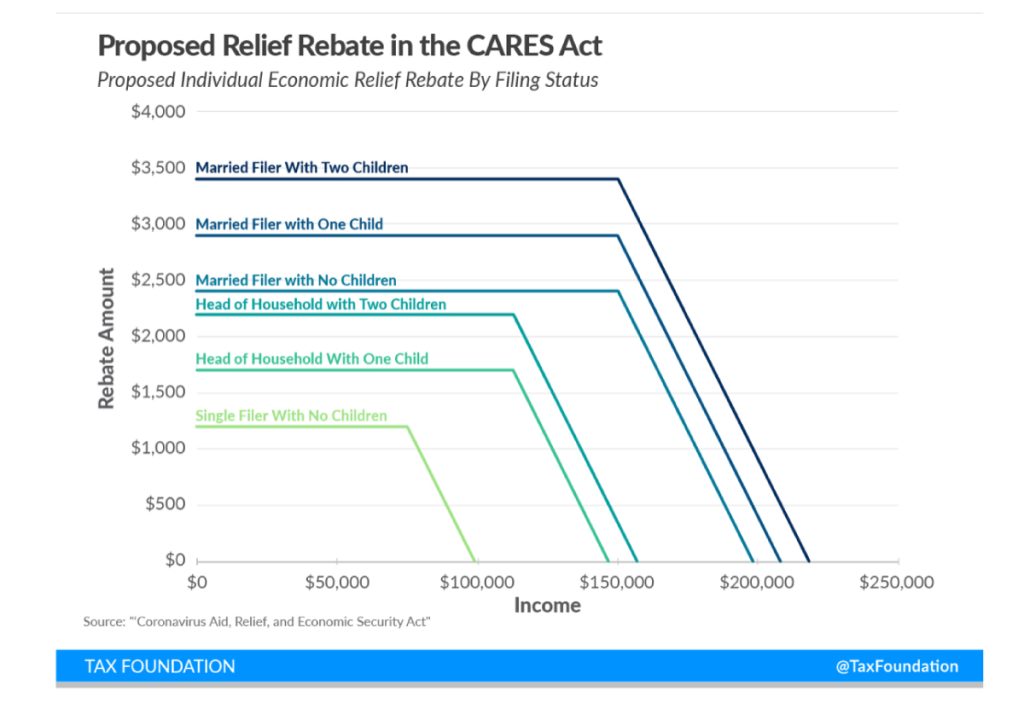

- Recovery Rebate for individual taxpayers. The bill would provide a $1,200 refundable tax credit for individuals ($2,400 for joint taxpayers). Additionally, taxpayers with children will receive a flat $500 for each child. The rebates would not be counted as taxable income for recipients, as the rebate is a credit against tax liability and is refundable for taxpayers with no tax liability to offset. The rebate phases out at $75,000 for singles, $112,500 for heads of household, and $150,000 for joint taxpayers at 5 percent per dollar of qualified income, or $50 per $1,000 earned. It phases out entirely at $99,000 for single taxpayers with no children and $198,000 for joint taxpayers with no children (see Chart). The 2019 or 2018 tax returns will be used to calculate the rebate advanced to taxpayers, but taxpayers eligible for a larger rebate based on 2020 income will receive it in the 2020 tax season. Taxpayers with higher incomes in 2020 will see the overpayment associated with their rebate forgiven. For example, a single taxpayer with $100,000 in 2019 income would not receive an advance rebate but would receive the $1,200 credit on their 2020 return if their income for the year fell below the phaseout. On the other hand, a single taxpayer with $35,000 in income receives a $1,200 advance rebate but would not have to pay the rebate back on the 2020 return if they make $100,000 this year.