Summary of Federal Tax Related Measures

A Temporary Wage Subsidy program has been made available for eligible employers (small CCPCs, NPOs, registered charities, unincorporated employers and certain partnerships ) that permits employers to reduce income tax remittances by 10% of remuneration paid to employees between March 18 and June 20, 2020 to a maximum of $1,375 per employee and $25,000 per employer (an employer cannot reduce its required CPP or EI premiums). On March 27th, Trudeau announced up to 75 per cent wage subsidy for qualifying businesses, for up to 3 months, retroactive to March 15, 2020. On March 30, 2020 Trudeau gave an update on this program and stated businesses that show a 30% decrease in revenue due to COVID-19 will be eligible for the subsidy. This applies to all businesses regardless of size and includes those in the not-for-profit and charitable sectors. The subsidy will cover 75% of salaries on the first $58,700 earned – which equals payments of up to $847 per week. Further details will be released April 1, 2020.

Collection and Audit Activities:

Starting March 18, the CRA will not contact any small or medium (SME) businesses to initiate any post assessment GST/HST or Income Tax audits for the next four weeks (i.e. starting March 18, 2018).

The CRA has suspended collection activities on new tax debts until further notice;

The CRA is currently holding most notice of objections in abeyance, other than those related to benefit and credit entitlements;

As a temporary administrative measure, the CRA will recognize electronic signatures as having met the signature requirements in respect of Forms T183 and T183CORP;

For any objection request [i.e., notice of objection] due March 18 or later, the deadline is effectively extended until June 30, 2020

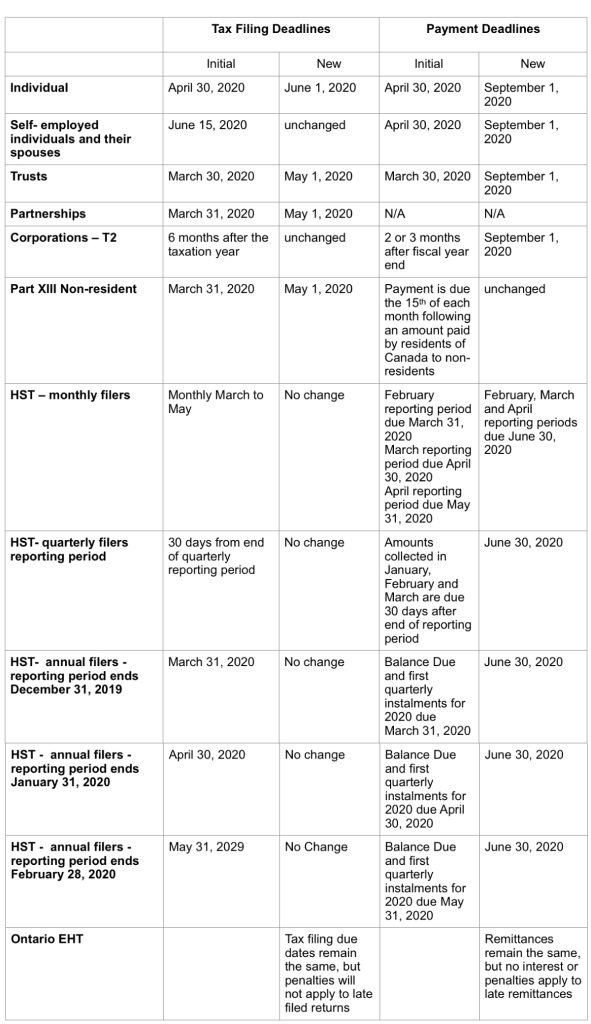

Tax Filing and Payment Deadlines:

Summary of Federal Business Financing Support Measures:

Canada Emergency Business Account

The new Canada Emergency Business Account will be implemented by eligible financial institutions in cooperation with Export Development Canada (EDC).

This $25 billion program will provide interest-free loans of up to $40,000 to small businesses and not-for-profits, to help cover their operating costs during a period where their revenues have been temporarily reduced, due to the economic impacts of the COVID-19 virus.

Small businesses and not-for-profits should contact their financial institution to apply for these loans.

To qualify, these organizations will need to demonstrate they paid between $50,000 to $1 million in total payroll in 2019. Repaying the balance of the loan on or before December 31, 2022 will result in loan forgiveness of 25 percent (up to $10,000).

A New Loan Guarantee for Small and Medium Enterprises

Small and medium-sized enterprises (SMEs) may be particularly vulnerable to the impacts of COVID-19. To support their operations, EDC will guarantee new operating credit and cash flow term loans that financial institutions extend to SMEs, up to $6.25 million.

A New Co-lending Program for Small and Medium Enterprises

To provide additional liquidity support for Canadian businesses, the Co-Lending Program will bring the Business Development Bank of Canada (BDC) together with financial institutions to co-lend term loans to SMEs for their operational cash flow requirements.

Eligible businesses may obtain incremental credit amounts up to $6.25 million BDC’s portion of this program is up to $5 million maximum per loan. Eligible financial institutions will conduct the underwriting and manage the interface with their customers. The potential for lending for this program will be $20 billion.

There has been an increased in funding made available to Farm Credit Canada (FCC), which provides credit to farmers and the agri-food sector ;

Effective March 30, a six-month interest-free moratorium has been placed on Canada Student Loans repayment requirements for all student loan borrowers. No payment will be required, and interest will not accrue during this time. Students do not need to apply for the repayment pause. See Parts 13 and 15 of the COVID-19 Emergency Response Act;

Canadian banks have committed to work with their customers on a case-by-case basis to find solutions to help them manage hardships caused by COVID-19. Canadians who are impacted by COVID-19 and experiencing financial hardship as a result should contact their financial institution regarding flexibility for a mortgage deferral. Contact your financial institution for further mortgage assistance.

The COVID-19 Emergency Response Act Receives Royal Assent

This legislation:

• Provides additional assistance to families with children by temporarily boosting Canada Child Benefit payments, delivering almost $2 billion in extra support.

• Provides additional assistance to individuals and families with low and modest incomes with a special top-up payment under the Goods and Services Tax (GST) credit, delivering $5.5 billion in support.

• Introduces a Canada Emergency Response Benefit (CERB) providing a taxable benefit of $2,000 a month for up to 4 months to support workers who lose their income as of result of the COVID-19 pandemic. The benefit would cover Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. Additionally, workers who are still employed, but are not receiving income because of disruptions to their work situation related to COVID-19, would also qualify for the CERB. The CERB is available to Canadian workers affected by the current situation whether or not they are eligible for Employment Insurance (EI).

• Introduces a pause on the repayments of Canada Student Loans in the Canada Student Financial Assistance Act, the Canada Student Loans Act, and the Apprenticeship Loans Act in order to introduce a 6-month moratorium on the repayment of Canada Student Loans for all borrowers currently in repayment.

• Helps businesses keep their workers by providing eligible small employers a temporary wage subsidy for a period of three months. Eligible employers would include small businesses (including co-operative corporations) eligible for the small business deduction, unincorporated employers, certain partnerships, non-profit organizations and charities.

• Helps protect seniors’ retirement savings from the impact of volatile market conditions by reducing required minimum withdrawals from Registered Retirement Income Funds by 25 per cent for 2020.

• Supports the protection of Canadians’ savings by providing the Minister of Finance with the flexibility to increase the Canada Deposit Insurance Corporation’s deposit insurance limit beyond its current level of $100,000.

Ontario Economic and Fiscal Update

The Minister of Finance released an economic and fiscal update on March 25, 2020 instead of a full budget. Furthermore, the province released Ontario’s Action Plan 2020: Responding to Covid-19. Excerpts from the Action Plan with tax implications are reproduced below:

Seniors

The Province is providing immediate financial support of an additional $75 million to 194,000 vulnerable seniors, who may need more help to cover essential expenses during the COVID 19 outbreak, by proposing to double the Guaranteed Annual Income System (GAINS) maximum payment for low-income seniors, for six months starting in April 2020. This would increase the maximum payment to $166 per month for individuals and $332 per month for couples. The government is also helping seniors by providing $5 million to support the coordination of subsidized deliveries of meals, medicines and other essentials, by working with local businesses and charities as well as existing health services.

Parents

To help parents pay for the extra costs associated with the closure of schools and daycares during the COVID 19 outbreak, the government is providing a one-time payment of $200 per child up to 12 years of age, and $250 for those with special needs, including kids enrolled in private schools. As part of the government’s efforts to contain the COVID 19 outbreak, Ontario is also providing emergency child care options to enable parents who are front-line workers to report for work, such as health care workers, police officers, fire fighters and correctional officers.

Students

The government is temporarily suspending Ontario Student Assistance Program (OSAP) loan repayments between March 30, 2020 and September 30, 2020, during which time borrowers will not be required to make any loan or interest payments. In coordination with the federal government’s measures, this will immediately leave more money in the pockets of student borrowers during these challenging economic times.

Workers

The government is taking further measures to support Ontario workers, with initiatives including:

Quickly passing legislation to provide job-protected leave to employees in isolation or quarantine, or those who need to be away from work to care for children because of school or daycare closures due to the COVID 19 outbreak; Committing $100 million in funding through Employment Ontario for skills training programs for workers affected by the COVID 19 outbreak; and Working with the federal government to find ways to support apprentices and enable businesses to continue to retain these skilled trades workers during the COVID 19 outbreak.

Electricity Relief

The government is supporting people and businesses with the costs of electricity during the COVID 19 outbreak. That is why the government is: Providing $9 million in direct support to families for their energy bills by expanding eligibility for the Low income Energy Assistance Program (LEAP) and by ensuring that their electricity and natural gas services are not disconnected for nonpayment during the COVID 19 outbreak; and Supporting more affordable electricity bills for eligible residential, farm and small business consumers, by providing approximately $5.6 billion for electricity cost relief programs in 2020–21. This is an increase of approximately $1.5 billion compared to the 2019 Budget plan. The Province is also setting electricity prices for residential, farm and small business time-of-use customers at the lowest rate, known as the off-peak price, 24 hours a day for 45 days to support ratepayers in their increased daytime electricity usage as they respond to the COVID 19 outbreak, addressing concerns about time-of-use metering.

Employer Health Tax

The government is cutting taxes by $355 million for about 57,000 employers by proposing a temporary increase to the Employer Health Tax (EHT) exemption from $490,000 to $1 million for 2020. With this plan, more than 90 per cent of private-sector employers would not pay EHT in 2020. Eligible private-sector employers with annual payrolls up to $5 million would be exempt from EHT on the first $1 million of total Ontario remuneration in 2020. The maximum EHT relief from the exemption would increase by $9,945 to $19,500 for 2020 for eligible employers. About 57,000 private-sector employers would pay less EHT, including about 30,000 who would not pay any EHT for 2020, effectively eliminating EHT for these employers for one year. The exemption would return to its current level of $490,000 on January 1, 2021.

Regional Opportunities Investment Tax Credit

To support business investment in regions of the province where employment growth has been significantly below the provincial average, Ontario is proposing a new 10 per cent refundable Corporate Income Tax credit. The Regional Opportunities Investment Tax Credit would be available to eligible businesses that construct, renovate or acquire qualifying commercial and industrial buildings in designated regions of the province, saving them up to $45,000 in the year.

Support for People and Businesses to Improve Cash Flow

Ontario is making $10 billion available to improve cash flows for people and businesses through tax and other deferrals over the coming months to provide relief during this challenging economic time, in coordination with the federal government.

$6 Billion in Tax Deferrals

To help support Ontario businesses when they need it most, the government is providing a five-month interest and penalty-free period for businesses to make payments for the majority of provincially administered taxes. Beginning April 1, 2020, the Province is providing flexibility to about 100,000 businesses in Ontario to help manage their cash flows during this challenging time. This will continue for a period of five months, up until August 31, 2020, and is expected to make available $6 billion to improve the cash flows of Ontario businesses. For this period, the Province will not apply any penalty or interest on any late-filed returns or incomplete or late tax payments under select provincially administered taxes, such as the Employer Health Tax, Tobacco Tax and Gas Tax. The initiative and relief period complement the relief from interest and penalties from not remitting Corporate Income Tax owing that was announced by the federal government on March 18, 2020.

$1.8 Billion in Education Property Tax Deferrals

The Province recognizes that many residents and businesses are facing challenges in making their scheduled property tax payments. The government is working closely with municipalities as they introduce measures to provide property tax relief, for example, by allowing taxpayers to defer property tax payments. To encourage these actions, the government is deferring the property tax payments municipalities make to school boards by 90 days. In addition to collecting municipal property taxes, municipalities collect and remit education property taxes to school boards on a quarterly basis. Deferring the June 30 quarterly remittance to school boards by 90 days will provide municipalities with the flexibility to, in turn, provide over $1.8 billion in property tax deferrals to residents and businesses. To ensure this does not have a financial impact on school boards, the Province will adjust payments to school boards to offset the deferral.

$1.9 Billion in Workplace Safety Expenses

Working in conjunction with the government of Ontario, the Workplace Safety and Insurance Board (WSIB) will allow employers to defer payments for a period of six months. This will provide employers with $1.9 billion in financial relief. All employers covered by the WSIB’s workplace insurance are automatically eligible for the financial relief package. Schedule 1 employers with premiums owed to the WSIB will be allowed to defer reporting and payments until August 31, 2020. The deferral will also apply to Schedule 2 businesses that pay WSIB for the cost related to their workplace injury and illness claims. In addition, no interest will be accrued on outstanding premium payments and no penalties will be charged during this six-month deferral period.