On October 21, 2021, the Government of Canada announced new proposed COVID-19 recovery programs as most of the existing support programs were set to expire on October 23rd, 2021. The addition of the Tourism and Hospitality Recovery Program as well as the Hardest-Hit Business Recovery Program have been proposed to assist the businesses greatly impacted by the pandemic.

Each new program has been summarized below:

Programs available until May 2022

- The Tourism and Hospitality Recovery Program

- The Hardest-Hit Business Recovery Program

- Canada Recovery Hiring Program (Extended)

1: Tourism and Hospitality Recovery Program

- General information:

- Program length – From November 20, 2021 to May 7, 2022

- Covers both rent and wage subsidy

- Eligible organizations:

- Hotels, restaurants, bars, festivals, travel agencies, tour operators, convention centres, convention and trade show organizers, and others.

- To qualify – meet both:

- Average revenue reduction of at least 40% over the first 13 CEWS periods (from March 2020 to February 2021)

- Current-month revenue loss of at least 40%

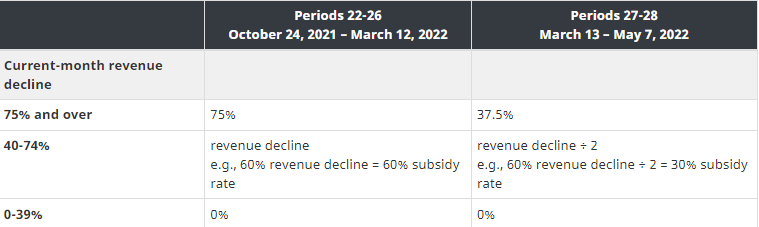

- Subsidy rate:

- Subsidy calculated based on current month revenue loss (same as existing rules)

- Maximum 75%, Minimum 40%. From October 24, 2021 to March 12, 2022 (claims 22 to 26)

- March 13, 2022 subsidy rates cut in half. That would be period 27 & 28.

- Top-up 25% – based on days shut down

2: The Hardest-Hit Business Recovery Program

- General information:

- Program length – From November 20, 2021 to May 7, 2022

- Covers both rent and wage subsidy

- Eligible organizations:

- All other organizations that do not qualify for the above program that have been deeply affected

- To qualify – meet both:

- Average revenue reduction of at least 50% over the first 13 CEWS periods (from March 2020 to February 2021)

- Current-month revenue loss of at least 50%

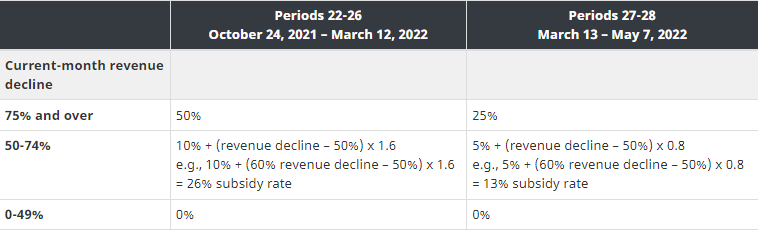

- Subsidy rate:

- Subsidy calculated based on current month revenue loss (same as existing rules)

- Maximum 50%, Minimum 0%. From October 24, 2021 to March 12, 2022 (claims 22 to 26)

- March 13, 2022 subsidy rates cut in half. That would be period 27 & 28.

- Top-up 25% – based on days shut down

3: Canada Recovery Hiring Program

- General information:

- Program length – From June 6, 2021 to May 7, 2022

- Eligible organizations:

- You had a CRA payroll account on March 15, 2020 (exceptions apply in payroll provider and asset acquisition situations)

- You are an eligible employer

- To qualify – meet both:

- Current month revenue loss above 10%

- Subsidy rate:

- Increase of the subsidy rate up to 50 per cent

- CRHP is calculated using how much your overall pay to your employees (per employee) has increased from the time of the base period of March 14 to April 10, 2021, to the time of the claim period.